Australian Index (SPI) Futures

http://austindex.blogspot.com/

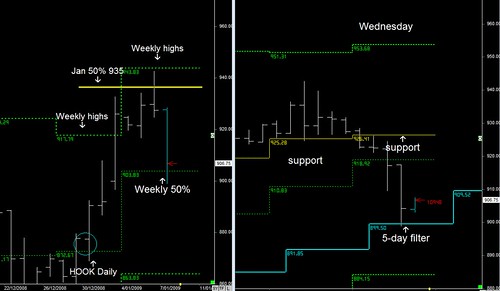

DOW and S&P Index Futures

http://usindexweekly.blogspot.com/

EUR/USD, AUD/USD. GBP/USD

http://www.forexspread.blogspot.com/

Note: Weekly BHP and Banking Reports Update

http://aussie-stocks.blogspot.com/

There is also a new Article found in the Trader SET:- intra-day timing techniques for day-trading the SPI futures.

- Daily Trading Set-ups & Analysis