Australian Index (SPI) Futures

http://austindex.blogspot.com/

DOW and S&P Index Futures

http://usindexweekly.blogspot.com/

US Dollar INDEX, AUD/USD, EUR/USD

http://www.forexspread.blogspot.com/

OIL Futures:- OIL BOIL

http://www.oilboil.blogspot.com/

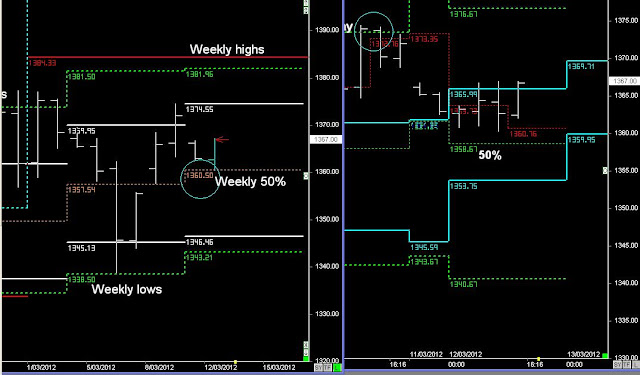

Gold & Silver Weekly Reports

http://goldcoppersilver.blogspot.com/

Note: Weekly BHP, RIO, TLS, Banking Report Update

http://aussie-stocks.blogspot.com/

- Daily Trading Set-ups & Analysis

- Index Futures SPI, DOW S&P, & Forex

- Subscribe to the Trader Premium

- http://www.datafeeds.com.au/premiumtrader.html